Rules of Origin for the AIFTA

In determining the origin of products eligible for the preferential tariff treatment under ASEAN-India Free Trade Area pursuant to Article 4 of this Agreement, the following Rules shall be applied:

RULE 1

Definitions

For the purposes of this Annex, the term:

(a) CIF means the value of the good imported, and includes the cost of freight and insurance up to the port or place of entry into the country of importation;

(b) FOB means the free-on-board value as defined in paragraph 1 of Appendix A;

(c) material means raw materials, ingredients, parts, components, subassembly and/orgoods that are physically incorporated into another good or are subject to a process in the production of another good;

(d) originating products means products that qualify as originating in accordance with the provisions of Rule 2;

(e) production means methods of obtaining goods includinggrowing, mining, harvesting, raising, breeding, extracting, gathering, collecting, capturing, fishing, trapping, hunting, manufacturing, producing, processing or assembling a good;

(f) Product Specific Rules are rules that specify that the materials have undergone a change in tariff classification or a specific manufacturing or processing operation, or satisfy an ad valorem criterion or a combination of any of these criteria;

(g) product means products which are wholly obtained/produced or being manufactured, even if it is intended forlateruse in another manufacturing operation;

(h) identical and interchangeable materials means materials being of the same kind possessing similar technical and physical characteristics, and which once they are incorporated into the finished product cannot be distinguished from one another for origin purposes.

RULE 2

Origin Criteria

For the purposes of this Annex, products imported by a Party which are consigned directly within the meaning of Rule 8 shall be deemed to be originating and eligible for preferential tariff treatment if they conform to the origin requirements under any one of the following:

(a) Products which are wholly obtained or produced in the exporting Party as set out and defined in Rule 3; or

(b) Products not wholly produced or obtained in the exporting Party provided that the said products are eligible under Rule 4 or 5 or 6.

RULE 3

Wholly Produced or Obtained Products

Within the meaning of Rule 2(a), the following shall be considered as wholly produced or obtained in a Party:

(a) plant1 and plant products grown and harvested in the Party;

(b) live animals2 born and raised in the Party;

(c) products3 obtained from live animals referred to in paragraph (b);

(d) products obtained from hunting, trapping, fishing, aquaculture, gathering or capturing conducted in the Party;

(e) minerals and other naturally occurring substances, not included in paragraphs (a) to (d), extracted or taken from the Party’s soil, waters, seabed or beneath the seabed;

(f) products taken from the waters, seabed or beneath the seabed outside the territorial waters of the Party, provided that that Party has the rights to exploit such waters, seabed and beneath the seabed in accordance with the United Nations Convention on the Law of the Sea, 1982;

(g) products of sea-fishing and other marine products taken from the high seas by vessels registered with the Party and entitled to fly the flag of that Party;

(h) products processed and/or made on board factory ships registered with the Party and entitled to fly the flag of that Party, exclusively from products referred to in paragraph (g);

(i) articles collected in the Party which can no longer perform their original purpose nor are capable of being restored or repaired and are fit only for disposal or recovery of parts of raw materials, or for recycling purposes4; and

(j) products obtained or produced in the Party solely from products referred to in paragraphs (a) to (i).

RULE 4

Not Wholly Produced or Obtained Products

(a) For the purposes of Rule 2(b), a product shall be deemed to be originating if:

(i) the AIFTA content is not less than 35 per cent of the FOB value; and

(ii) the non-originating materials have undergone at least a change in tariff sub-heading (CTSH) level of the Harmonized System, provided that the final process of the manufacture is performed within the territory of the exporting Party.

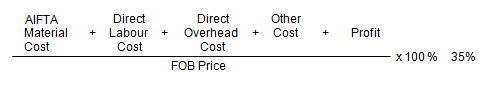

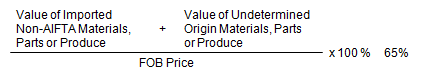

(b) For the purposes of this Rule, the formula for the 35 per cent AIFTA content is calculated respectively as follows5:

(i) Direct Method

(ii) Indirect Method

(c) The value of the non-originating materials shall be:

(i) the CIF value at the time of importation of the materials, parts or produce; or

(ii) the earliest ascertained price paid for the materials,partsor produce of undetermined origin in the territory of the Party where the working or processing takes place.

(d) The method of calculating the AIFTA content is as set out in Appendix A.

RULE 5

Cumulative Rule of Origin

Unless otherwise provided for, products which comply with origin requirements provided for in Rule 2 and which are used in a Party as materials for a product which is eligible for preferential treatment under the Agreement shall be considered as products originating in that Party where working or processing of the product has taken place.

RULE 6

Product Specific Rules

Notwithstanding the provisions of Rule 4, products which satisfy the Product Specific Rules shall be considered as originating from that Party where working or processing of the product has taken place. The list of Product Specific Rules shall be appended as Appendix B.

RULE 7

Minimal Operations and Processes

(a) Notwithstanding any provisions in this Annex, a product shall not be considered originating in a Party if the following operations are undertaken exclusively by itself or in combination in the territory of that Party:

(i) operations to ensure the preservation of products in good condition during transport and storage (such as drying,freezing, keeping in brine, ventilation, spreading out, chilling, placing in salt, sulphur dioxide or other aqueous solutions, removal of damaged parts, and like operations);

(ii) simple operations consisting of removal of dust, sifting or screening, sorting, classifying, matching (including the making-up of sets of articles), washing, painting, cutting;

(iii) changes of packing and breaking up and assembly of consignments;

(iv) simple cutting, slicing and repacking or placing in bottles, flasks, bags, boxes, fixing on cards or boards, and all other simple packing operations;

(v) affixing of marks, labels or other like distinguishing signs on products or their packaging;

(vi) simple mixing of products whether or not of different kinds, where one or more components of the mixture do not meet the conditions laid down in this Annex to enable them to be considered as originating products;

(vii) simple assembly of parts of products to constitute a complete product;

(viii) disassembly;

(ix) slaughter which means the mere killing of animals; and

(x) mere dilution with water or another substance that does not materially alter the characteristics of the products.

(b) For textiles and textile products listed in Appendix C, an article or material shall not be considered to be originating in a Party by virtue of merely having undergone any of the following:

(i) simple combining operations, labelling, pressing, cleaning or dry cleaning or packaging operations, or any combination thereof;

(ii) cutting to length or width and hemming, stitching or overlocking fabrics which are readily identifiable as being intended for a particular commercial use;

(iii) trimming and/or joining together by sewing, looping, linking, attaching of accessory articles such as straps, bands, beads, cords, rings and eyelets;

(iv) one or more finishing operations on yarns, fabrics or other textile articles, such as bleaching, waterproofing, decating, shrinking, mercerizing, or similar operations; or

(v) dyeing or printing of fabrics or yarns.

RULE 8

Direct Consignment

The following shall be considered as consigned directly from the exporting Party to the importing Party:

(a) If the products are transported passing through the territory of any other AIFTA Parties;

(b) If the products are transported without passing through the territory of any non-AIFTA Parties;

(c) The products whose transport involves transit through one or more intermediate non-Parties with or without transhipment or temporary storage in such non-Parties provided that:

(i) the transit entry is justified for geographical reason or by consideration related exclusively to transport requirements;

(ii) the products have not entered into trade or consumption there; and

(iii) the products have not undergone any operation there other than unloading and reloading or any operation required to keep them in good condition.

RULE 9

Treatment of Packing

(a) Packages and packing materials for retail sale, when classified together with the packaged product, shall not be taken into account in considering whether all non-originating materials used in the manufacture of a product fulfill the criterion corresponding to a change of tariff classification of the said product.

(b) Where a product is subject to an ad valorem percentage criterion, the value of the packages and packing materials for retail sale shall be taken into account in its origin assessment, in case the packing is considered as forming a whole with products.

(c) The containers and packing materials exclusively used for the transport of a product shall not be taken into account for determining the origin of any good.

RULE 10

Accessories, Spare Parts, Tools and Instructional or Other Information Material

The origin of accessories, spare parts, tools and instructional or other information materials presented with the products shall not be taken into account in determining the origin of the products, provided that such accessories, spare parts, tools and instructional or other information materials are:

(a) in accordance with standard trade practices in the domestic market of the exporting Party; and

(b) classified with the products at the time of assessment of customs duties by the importing Party.

However, if the products are subject to a qualifying AIFTA content requirement, the value of such accessories, spare parts tools and instructional or other information material shall be taken into account as originating or non-originating materials, as the case may be, in calculating the qualifying AIFTA content.

RULE 11

Indirect Materials

In order to determine whether a product originates in a Party, any indirect material such as power and fuel, plant and equipment, or machines and tools used to obtain such products shall be treated as originating whether such material originates in non-Parties or not, and its value shall be the cost registered in the accounting records of the producer of the export goods.

RULE 12

Identical and Interchangeable Materials

For the purposes of establishing if a product is originating when it is manufactured utilising both originating and non-originating materials, mixed or physically combined, the origin of such materials can be determined by generally accepted accounting principles of stock control applicable/inventory management practised in the exporting Party.

RULE 13

Certificate of Origin

A claim that a product shall be accepted as eligible for preferential tariff treatment shall be supported by a Certificate of Origin issued by a government authority designated by the exporting Party and notified to the other Parties in accordance with the Operational Certification Procedures as set out in Appendix D.

RULE 14

Review and Modification

This Annex and the Operational Certification Procedures may be reviewed and modified, as and when necessary, upon request of a Party and as may be agreed upon by the Joint Committee.

__________

1 Plant here refers to all plant life, including forestry products, fruit, flowers, vegetables, trees, seaweed, fungi and live plants.

2 Animals referred to in paragraphs (b) and (c) covers all animal life, including mammals, birds, fish, crustaceans, molluscs, reptiles, and living organisms.

3 Products refer to those obtained from live animals without further processing, including milk, eggs, natural honey, hair, wool, semen and dung.

4 This would cover all scrap and waste including scrap and waste resulting from manufacturing or processing operations or consumption in the same country, scrap machinery, discarded packaging and all products that can no longer perform the purpose for which they were produced and are fit only for disposal for the recovery of raw materials. Such manufacturing or processing operations shall include all types of processing, not only industrial or chemical but also mining, agriculture, construction, refining, incineration and sewage treatment operations.

5 The Parties shall be given the flexibility to adopt the method of calculating the AIFTA Content, whether it is the direct or indirect method. In order to promote transparency, consistency and certainty, each Party shall adhere to one method. Any change in the method of calculation shall be notified to all the other Parties at least six (6) months prior to the adoption of the new method. It is understood that any verification of the AIFTA content by the importing Party shall be done on the basis of the method used by the exporting Party.