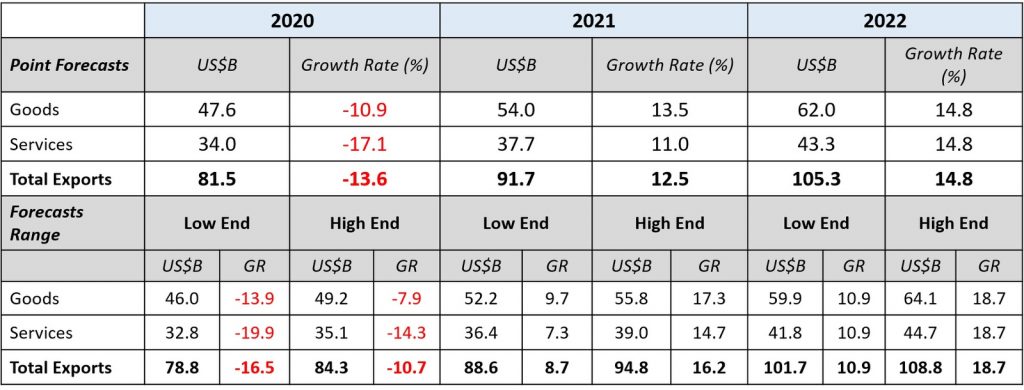

We have adjusted the export targets, taking into consideration impact of the pandemic and weaker global demand. Thus, the revised targets are lower than the original targets where export levels were originally projected to reach over USD 130B by 2022.

In this revised set of targets, we will reach USD 105B by 2022, but still growing from USD 91.7B in 2021. (These are Balance of Payments and International Investment Position Manual [BPM6] figures, net of consigned materials).

Given the height of the lockdown and the pandemic in 2020, estimated exports decline for that year is at -13.5%.

The positive growth of 2% in September and 3% in November last year was not enough to totally offset the decline in the first half of 2020 which was the height of the lockdown. But export numbers continued to improve month on month reaching positive growth by September and November vs their same month previous year numbers.

We can write off the 2020 numbers, so to speak, but the rebound is expected this year 2021, where we expect to bounce back to a +12.5% in 2021 and +14.8% in 2022.

We can consider these targets as fighting targets, after intensive consultations with each export sector and stakeholder and global market prospects per sector. This also means that we shall exert all efforts in terms of policies and support programs to assist the export sector and help them achieve these fighting targets. We expect the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill and other economic reforms to be passed in Congress, the Build, Build, Build, and other investment and export promotion including digitalization programs to drive up more investment inflows to increase our export capacities, and unleash our potentials in higher-value sectors such as in electronics, automotive, aerospace, Information Technology and Business Process Management (IT-BPM), copper and the creative industries, plus the potential in halal exports. ♦

Date Released: 20 January 2021