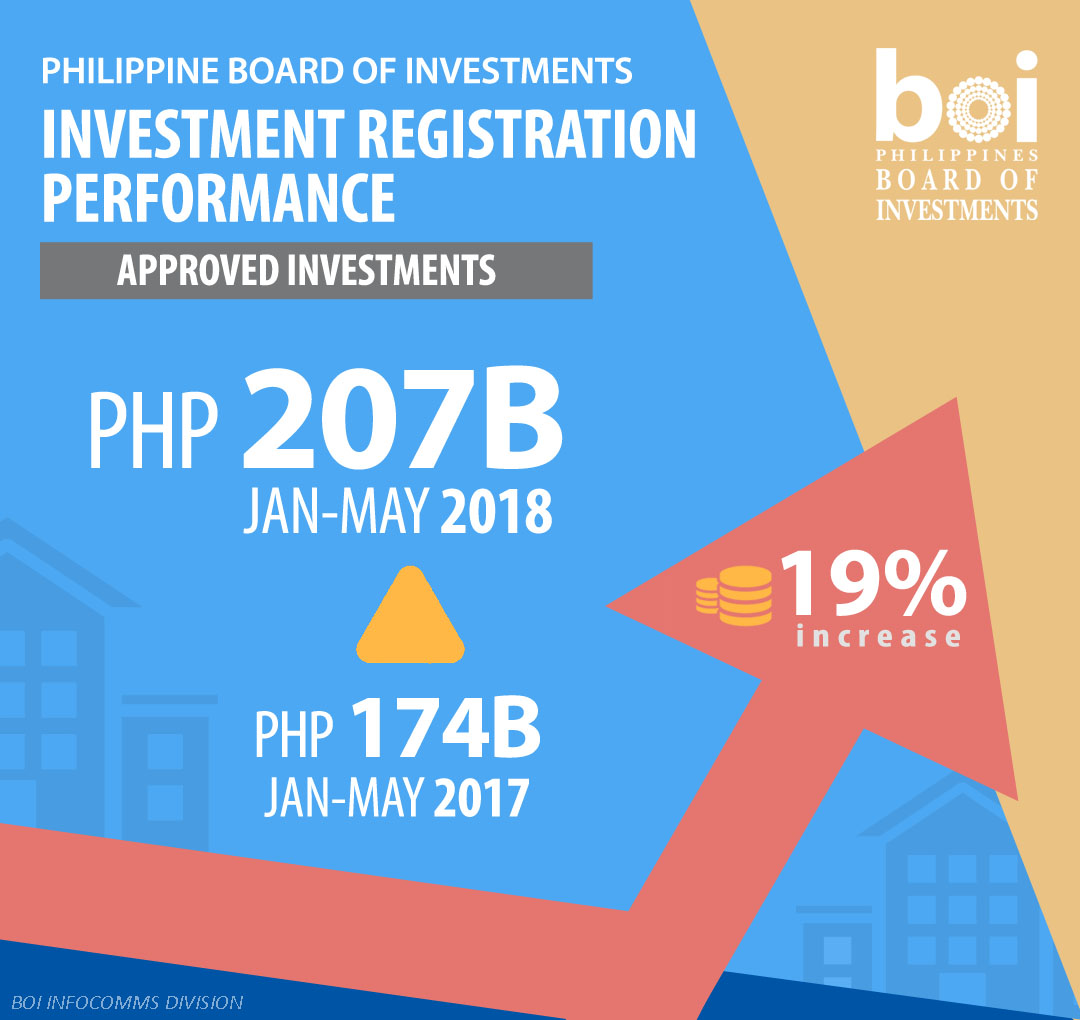

The growth in FDIs contributed to the overall increase in BOI registrations as investment projects approved the agency was up by 18.92 percent from January to May 2018 to P207.480 B from only P174.472 B recorded in the same period last year.

Actual FDIs compiled by Bangko Sentral ng Pilipinas (BSP) show USD2.2 B in net inflows as of the first quarter of 2018, up 43.5% from USD1.5B in the same period last year.

BOI data shows Japan the country’s top foreign investor with P2.645 B from January to May 2018, followed by Italy with P485M, China with P472M, United States with P463 M, and Hong Kong with P206.82 M.

Toyota Motor Philippines Corporation (TMPC) was the top investor for May 2018 increasing its additional investments in the CARS Program by P2.56 B, including the P899 M in body side member stamping. The body shell of Toyota Vios model is now manufactured locally from a previously purely welding operation. On the other hand, Mitsubishi Motor Philippines Corporation also reported an increase of P820 M which, together with Toyota’s new investments, brings in the total additional CARS investments of P3.38 B.

“The Philippines has a growing economy. In fact, our country is projected to grow more than five times its current economic size and become the 24th biggest economy in the world by 2030. Together with this growth, we see stronger demand for many projects on infrastructure, services, manufacturing, and utilities,” said Trade Secretary and BOI Chairman Ramon Lopez.

“An expanding economy also means a fast-growing consumer base and middle class with stronger purchasing power,” he said.

“These figures are just preliminaries. We expect more foreign investments to come in as a result of the various presidential visits and investment promotion activities conducted in the past months,” said Secretary Lopez.

Recently, the Philippine delegation to South Korea led by President Rodrigo Duterte yielded a total of USD4.8 B worth of investment pledges and business expansion intentions that are expected to generate an estimated 50,800 employment opportunities for Filipinos once these businesses are operational.

“The Philippine government is committed in widening its trade and investment engagements with other nations under President Rodrigo Duterte’s independent foreign policy. With the South Korean business community as our partner, we are confident of making progress with government initiatives like the Build, Build, Build infrastructure program, and the thrust towards developing micro, small, and medium enterprises,” Secretary Lopez said.

“Our next goal now is to ensure that these investment pledges and job opportunities will materialize, and allow us to share the economic gains of the country, especially to those at the bottom of the pyramid,” he said.

Registered investments from local sources also grew during the period with P200.547 B worth of projects. The figure is 18.60 percent higher compared to only P169.091 B in the same period last year.

The increase in investment registrations in the first five months of the year is buoyed by power and energy projects (P106.552 B), transportation and storage (P39.817 B), manufacturing (P19.358 B), real estate (P14.535 B), and water supply (P13.872 B).

“While the BOI’s current investment incentives are primarily geared towards domestic investors in strategic industries, the increase in FDI shows that there are opportunities for attracting foreign companies to serve domestic, contestable (by imports) markets, if only the relevant incentive tools are available,” said Trade Undersecretary for Industry Development and BOI Managing Head Ceferino Rodolfo. “It is in this context that we are supportive of the proposed TRAIN Package 2, in order to make our incentive regime more relevant and responsive to needs of investors in priority strategic and socially-relevant industries,” he said.

“The Department of Trade & Industry through the BOI, and Department of Finance (DOF) are closely collaborating in engaging the different stakeholders all over the country; as well as preparing the different IPAs on how to maximize the benefits from possible changes in TRAIN 2,” he said.

In terms of geographical investment locations, Region III has the most numbers of locators with P77.352 B followed by Region 1V with P57.991 B. The National Capital Region came only as third placer with P31.969 B as the 2017-2019 Investment Priorities Plan was purposely intended to disperse businesses outside Metro Manila. Region XI came in as fourth placer with P14.136 B, followed by Region VI with P3.493 B.