MAKATI – Six out of nine electronics exports groups reported positive growth for the first quarter despite the COVID-19 pandemic, according to data from the Philippine Statistics Authority (PSA). Automotive exports, in particular, grew 79% to USD57.4M from USD32.1M in the same period

Other gainers were Consumer Electronics (up by 40.9% to USD201.9M); Office Equipment, (up by 20.9% to USD133.2M); Control and Instrumentation (up by 7.9% to USD117.0M); Medical/Industrial Instrumentation, (up by 7.5% to USD31.5M); and Semiconductors (up by 0.5% to USD6.5B).

However, the cumulative positive difference in value posted by the six subsectors was not enough to offset the losses in the subsectors that declined, namely Electronic Data Processing, Communication and Radar, and Telecommunication..

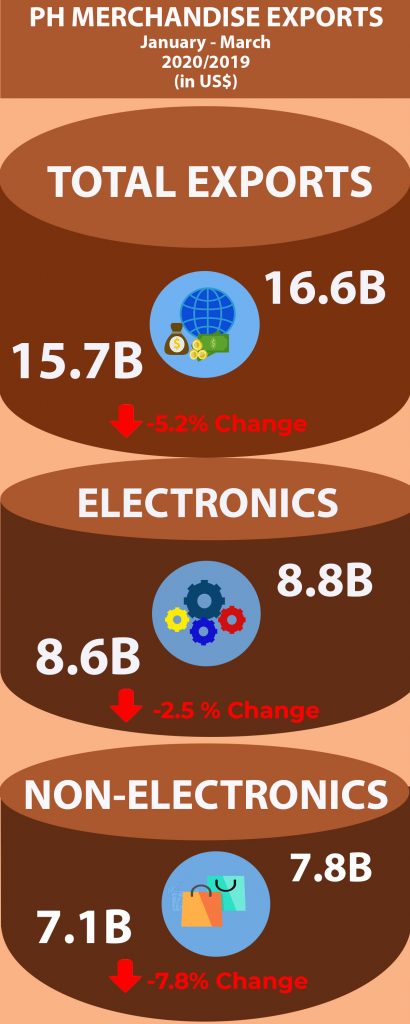

As a whole, Electronics went down by 2.5% to USD8.6B in the first quarter from USD8.8B in the same quarter a year ago, reversing the gains recorded in the first two months.

In total, Philippine merchandise exports slid by 24.9% in March alone to USD4.5B from USD6.0B in the same period last year. This was after positive growth in January and February.

This brought the year-to-date (YTD) export sales to a 5.2% decline to USD15.7B from USD16.6B in the same period a year ago. Electronics comprised 54.7% of the total value of PH merchandise exports, while Non-electronics made up the rest of 45.3% in the review period.

“A decline is expected in March since we are reeling from the effects of COVID-19. The Enhanced Community Quarantine has also just begun that month and we have refined our guidelines for transporting and exporting goods since then,” said Department of Trade and Industry (DTI) Undersecretary for Trade Promotions Group (TPG) Abdulgani M. Macatoman.

The negative showing was a result of the double-digit decreases in the export sales of nine of the top 10 major export commodities led by Metal Components (-40.9%); Machinery and Transport Equipment (-33.1%); Electronic Products (-24.0%), Ignition Wiring (-22.9%); and Coconut Oil (-22.2%).

Meanwhile, after the positive showing in the first two months, Non-Electronics’ export sales went back to the negative territory, declining by 8.1% to USD7.1B in the first three months from USD7.8B in the same period last year.

Exports to all the top 10 destinations of the Philippines in March 2020 posted negative growth rates led by South Korea (-45.0%), Taiwan (-39.1%), and US (-33.9%). In reverse order, the three economies were also the biggest decliners in YTD terms, incurring negative growth rates of -9.2%, -8.8%, and -7.8%, respectively. Overall, total exports to the top 10 markets declined by 23.3% to USD3.9B YTD from USD5.1B in the same period last year.

“We are saddened but not surprised,” said DTI-Export Marketing Bureau (EMB) Director Senen M. Perlada. “Right now we are studying the global market to help Philippine exports respond to the changing demands brought about by the COVID-19 pandemic. Due to the travel constraints, we recommend exporters to explore online marketspaces as a strategy even after the pandemic.”

Under the Enhanced Community Quarantine (ECQ), DTI maintained that export-oriented businesses will remain operational. It also issued memorandum circulars to reiterate the unhampered movement of cargo during the ECQ. ♦

Date of Release: 8 May 2020