SAN FERNANDO, PAMPANGA – The Department of Trade and Industry Region 3 (DTI-3) successfully held the fifth run of the Touchpoint Business Conference on March 26, 2024, via Zoom Conference.

With the theme, “Innovating Financial Services to Accelerate MSME Growth,” the virtual conference brought together industry leaders, MSMEs, professionals, members of the academe, local government units, and other government and non-government agencies to explore innovative strategies and solutions in financial services.

The sessions featured a dynamic lineup of distinguished speakers and thought leaders who shared valuable insights and expertise on various aspects of financial services and MSME development.

“We are thrilled with the overwhelming response and success of the Touchpoint 5.0,” said Director Brigida T. Pili, OIC Regional Director of DTI-3. “The event serves as a platform for industry stakeholders to come together, exchange ideas, and explore innovative approaches to accelerating MSME growth in Central Luzon. We are confident that the insights and connections made during the conference will have a lasting impact on the region’s business landscape.”

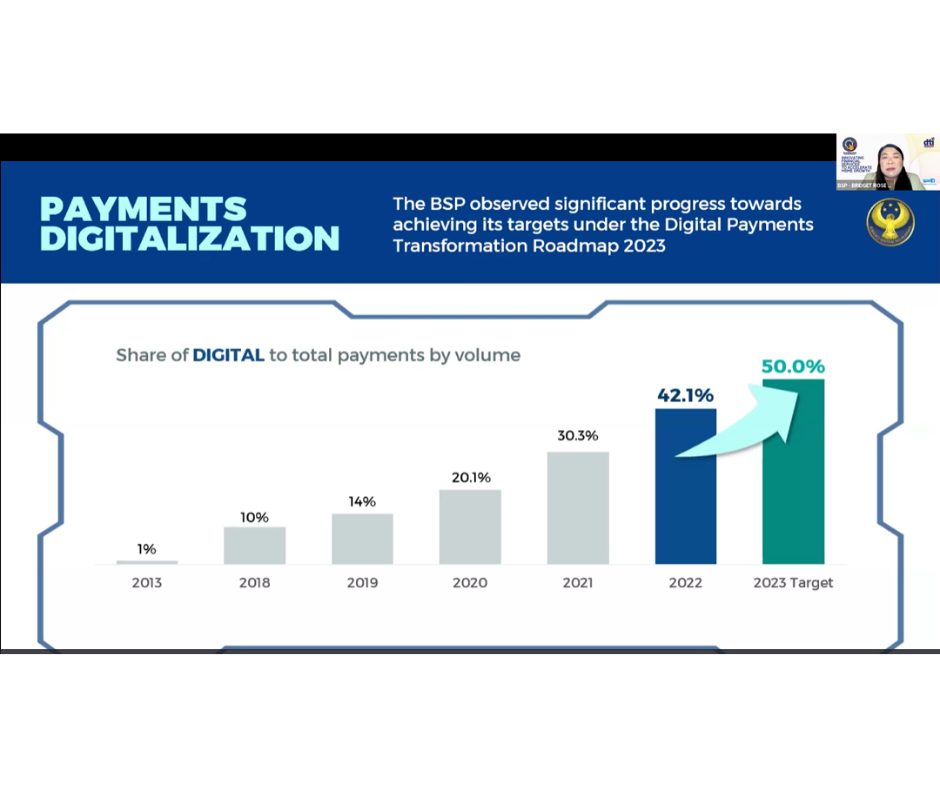

Throughout the conference, participants gained valuable insights into a wide range of topics. Atty. Bridget Rose M. Mesina-Romero of the Bangko Sentral ng Pilipinas provided

updates on the latest regulations on Digital Payments and Related Services including the QR Ph. The QR Ph is a unified QR code standard for payments in the Philippines. It allows consumers to conveniently make payments by scanning QR codes using their mobile banking apps or e-wallets, regardless of the provider. This initiative aims to promote interoperability and enhance the efficiency and accessibility of digital payments across different platforms and service providers.

Engr. Ramon Hernandez of the Cybersecurity Division of the Department of Information and Communications Technology (DICT) discussed cybersecurity measures and best practices in digital finance, highlighting the importance of safeguarding financial transactions and data against cyber threats.

Mr. Jan Dennis Cervantes, Senior Accounts Management Specialist of the Small Business Corporation (SB Corp) shared insights into the various sources of financing available to MSMEs through digital banking, empowering entrepreneurs with the knowledge to access funding for their businesses. He provided affordable loan options that can be availed of by MSMEs and budding entrepreneurs.

In addition, representatives from digital payment platforms showcased innovative solutions and technologies in digital payments. Mr. Renan Santiago of Maya, Mr. John Karlo Legarde of GCash, Ms. Jecca Masangkay, and Mr. Heall Penales of Paycools presented how their payment platforms cater to the needs of MSMEs and consumers for ease of digital payment.

The conference also featured a question-and-answer segment to address inquiries and foster interactive discussions among participants.

Almost 400 participants joined through the Zoom conference while more than 500 more tuned in the Facebook live stream. ♦

Date of release: 27 March 2024