As demand dries up and non-essential establishments temporarily close amidst the COVID pandemic, the Department of Trade and Industry (DTI), through its financing arm the Small Business Corporation (SB Corp.), opens a loan facility for micro, small, and medium enterprises (MSMEs) that decide to repurpose their production lines to cope up.

One business that availed of this DTI facility is Uniform Solutions (UNISOL), a start-up company for on demand uniforms based in Cebu.

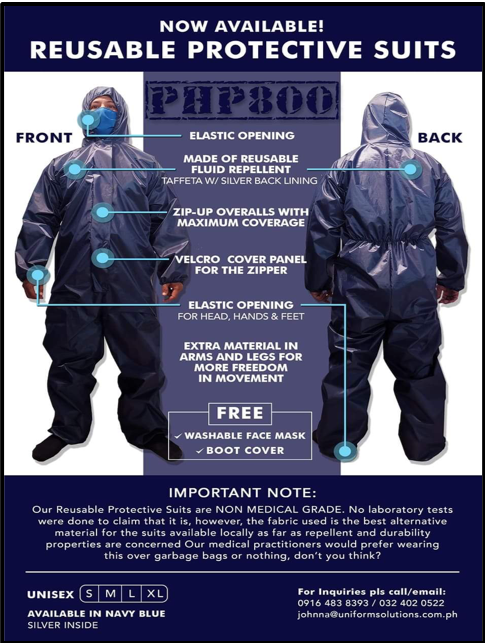

With an initial loan of P3M approved under DTI’s Small and Medium Enterprise – Personal Protective Equipment (SME-PPE) loan facility, UNISOL was able to retrofit its production operations to make washable face masks and reusable protective suits.

CEO Jonas Quilantang narrated how it took him five years to set-up operations and get ready for mass production, adopt technological innovations to improve existing products; have the machines, suppliers as well as the market ready.

“We wanted to make sure we can deliver the bulk orders expected of us and sustain our niche market,”Quilantang explained.

UNISOL was about ready to hold a grand company launch in early 2020 when a dire health situation developed in China.

Quilantang closely followed the news on the outbreak, had a hunch that the situation could worsen and knew a surge in demand for facemasks would follow.

He immediately made a strategic decision that changed the direction of his company.

“Before Luzon implemented its enhanced community quarantine (ECQ), I got the commitment from one of our suppliers for them to provide the needed fabric for the washable facemasks,” he said.

“We started making washable facemasks mid-March and reusable protective suits in early April this year,” Quilantang added.

Currently, UNISOL manufactures around 50,000 pieces of washable facemasks per day and 60,000 pieces of reusable protective suits a month.

UNISOL has reached the 1 million mark for facemasks as of 29 April this year.

After a month of production, Quilantang said that the company now has a stable supply of the products and is looking to widen its market by forging partnerships.

UNISOL is one good example of a company that effectively turned a negative situation into a good business opportunity, DTI-Regional Operations Group Assistant Secretary Asteria Caberte said.

Despite the challenges, the company found a way to repurpose its production operation which was originally designed to manufacture T-shirts, polo shirts and jackets to produce personal protective equipment (PPE), and keep its workers employed, ASec. Caberte explained.

Like UNISOL, SMEs can also avail of the DTI loan facility by getting in touch with any of the DTI-Central Visayas provincial offices to signify their interest and to get an endorsement to the SB Corporation.

Micro enterprises with an asset size of not more than P3M can borrow P10,000 to P200,000 while small enterprises with an asset size of not more than P10M can borrow a higher loan amount but not exceeding P500,000, she said.

Caberte encourages MSME business owners to contact any of the DTI Central Visayas Provincial Offices to signify their interest and to get an endorsement to SB Corporation:

DTI Cebu Provincial Office:

Tel No.: (032) 255-6971

Email: r07.cebu@dti.gov.ph

FB: https://www.facebook.com/DTI.Cebu/

DTI Bohol Provincial Office:

Tel No.: (038) 501 8828

Email: r07.bohol@dti.gov.ph

FB: https://www.facebook.com/DTI.BoholProvince/

DTI Negros Oriental Provincial Office:

Tel.No. (035) 422 5509

Email: r07.negrosoriental@dti.gov.ph

FB: https://www.facebook.com/DTI7.NegrosOriental/

DTI Siquijor Provincial Office :

Tel No.: (035) 480-9065

Email: r07.siquijor@dti.gov.ph

FB: https://www.facebook.com/DTI7.Siquijor/

Borrowers may also contact SB Corporation’s Toll Free Hotline # 1-800-10-6513333

Email: p3@sbgfc.org.ph or sbcorporation@sbgfc.org.ph

FB: https://www.facebook.com/PondoSaPagbabagoAtPagasenso/

♦

Date of Release: 6 May 2020