The Philippine Department of Trade and Industry (DTI), through the Philippine Trade and Investment Center (PTIC) Mexico City, Foreign Trade Service Corps (FTSC) and the Export Marketing Bureau (EMB), held last July 28 a webinar discussing the untapped potential of Latin American markets that Filipino exporters could pursue.

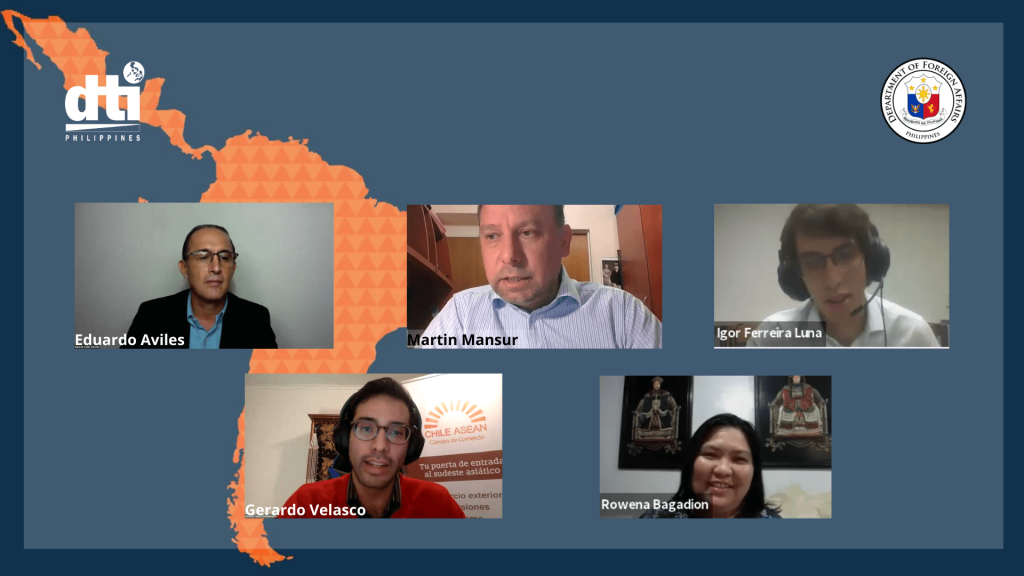

The webinar featured experts from key markets in Mexico, Brazil, Argentina, and Chile who gave in-depth discussions on the challenges and opportunities of tapping into the Latin American market and how to bridge the commercial gap between these countries and the Philippines. The speakers also discussed the product categories that Philippine exporters should explore and insights on doing business in Latin America in a post-pandemic context.

The event, moderated by PTIC Mexico Commercial Counsellor Vichael Roaring, also featured the launch of PTIC Mexico’s Doing Business in LatAM Guide. This exporter’s guide, which may be downloaded from the FTSC and PTIC web microsites, contains information on the country economy, top imports from the world, trade relations with the Philippines, market challenges, market opportunities, market entry strategy, business culture, and business chamber and association contacts for Chile, Brazil, Mexico, Argentina, and Colombia.

DTI Undersecretary for the Trade and Promotions Group Abdulgani Macatoman in his welcome remarks emphasized the timeliness of diversifying markets and doubling efforts to increase exports to bounce back from the economic slowdown caused by the COVID-19 pandemic.

EMB Director Senen Perlada explained that electronics make up 66% of our merchandise exports to Latin America. As for the food sector, desiccated coconuts remain the main food product exported to Latin America as the Philippines supply roughly 80% of this product to the rest of the world. He also shared that the Philippines aims to pursue export opportunities in higher-value electronic products, motor vehicle parts, design-driven products like homes-style, furniture, décor, fashion, accessories and jewelry, as well as personal care products, fresh and processed food, coconut products, health and wellness products, wines and spirits, organic products, and halal and Kosher products. He added that the Philippines also plans to explore service exports in tourism, education services, IT-enabled services, and creative services in Latin America.

Eduardo Aviles, Director of Bionutrients International, a Mexican manufacturer and marketer of health supplements, shared the importance of e-commerce in the post-pandemic market and why Mexico would be a strategic trade partner in that context. He shared that strategic alliances with Mexican companies can cut costs and achieve the best pricing, since Mexican companies can do license manufacturing, finishing or co-branding and leverage its logistical advantages with its access to the United States.

Economist Martin Mansur of Camara del Asia, the Argentine Chamber of Commerce for Asia, gave an overview of Argentina as the 3rd largest economy in Latin America after Brazil and Mexico, with a people market of 270 million people. He shared that Argentina’s most dynamic sectors include agribusiness, energy, mining, technology, tourism, and telecommunications, which Filipino exporters could explore.

Igor Ferreira Luna, Executive Director of the Brazil Coconut Institute, spoke extensively about the coconut market in Brazil, especially for desiccated coconuts where there is an opportunity for larger purchases. In 2019, Brazil imported 21 tons of desiccated coconuts from Asia, but only 38% of this volume came from the Philippines. He pointed out the high 55 percent tariff imposed by Brazil on Philippine coconut product exports compared to the 10 percent tariff in other South American countries. He emphasized the need to lower this tariff rate, pursue a reciprocity agreement with the Philippines, and in effect increase imports of coconuts products from the Philippines by 20 percent.

Gerardo Velasco, President and founder of the Chile-ASEAN Chamber of Commerce, discussed how Chile is a regional leader in ease of doing business, global competitiveness, human development, and global innovation. Chile enjoys trade preferences with 67% of the world population, with 29 trade agreements with 65 economies. It also has a strong service sector and a platform to access the Pacific Alliance and Latin American markets. From 2017 to 2019, Philippine top exports to Chile include printing machinery, electronics, chemicals, textiles, garments, coconuts, nuts, medical appliances, personal care, and watches. Niche areas that have rising consumption during the pandemic include internet retail, electronics, medical and cleaning supplies, and home and office supplies. He also advised that high-growth sectors include digital economy and consultancy services, while local and international investors continue to be interested in fusions, acquisitions, and private equity. He also advised that the Philippines can be Chile’s alternative source for rubber-based products, medical disposables, chemical products, palm oil and coconut products, food ingredients, personal care products, and IT services.

Rowena Bagadion, Chairman & CEO of consultancy firm WBagadion Consulting, discussed creative services and content exports in Colombia and the “orange economy” which broadly speaking covers creative industries. She highlighted cinema/film production, performing and audiovisual arts, IT and software production, publishing, animation and videogames, handicrafts, fashion and jewelry as the market segments that present big export opportunities in Colombia’s orange economy.

Aside from the market insight from industry leaders, all four Philippine ambassadors based in Latin America, Ambassadors Demetrio Tuason, Marichu Mauro, Ma. Teresita Daza, and Linglingay Lacanlale, (Mexico, Brazil, Chile and Argentina respectively) joined the open forum to share their views on how Philippine exporters can develop trade opportunities in the region. ♦

Date of Release: 3 August 2020